Here’s the relevant charts:

https://www.cleanenergywire.org/factsheets/germanys-energy-consumption-and-power-mix-charts

Propably the more important one is this chart:

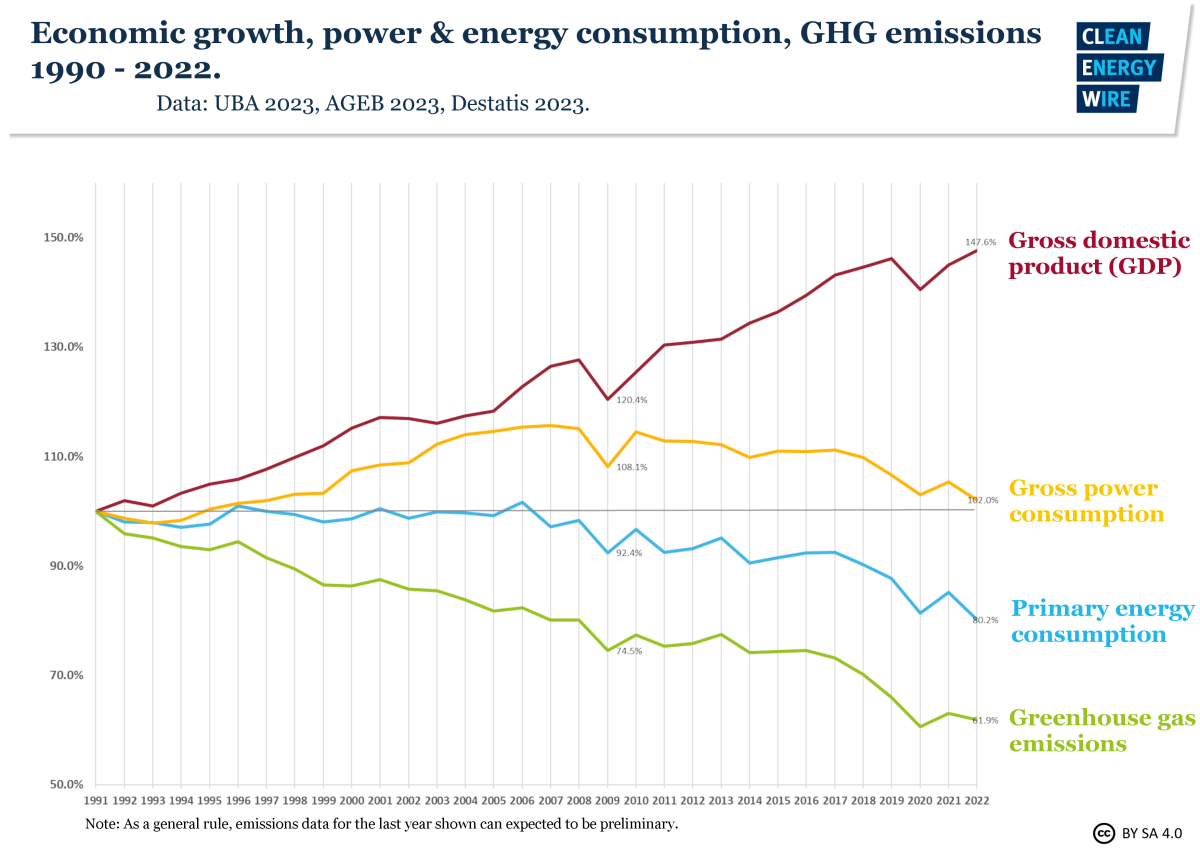

The fall was largely down to a recession in economic output– and a drop in energy-intensive production in particular – but warm weather and high energy prices also played a role, AEGB found.

Unfortunately, this is probably due to Putin turning off the gas. Forced austerity is not a sustainable climate solution, as COVID has demonstrated. Eventually the reasons for cutting back will naturally resolve or political pressure will force a return to the status quo.

We need to change both our grassroots politics and our infrastructure. Keep up the fight Germany!

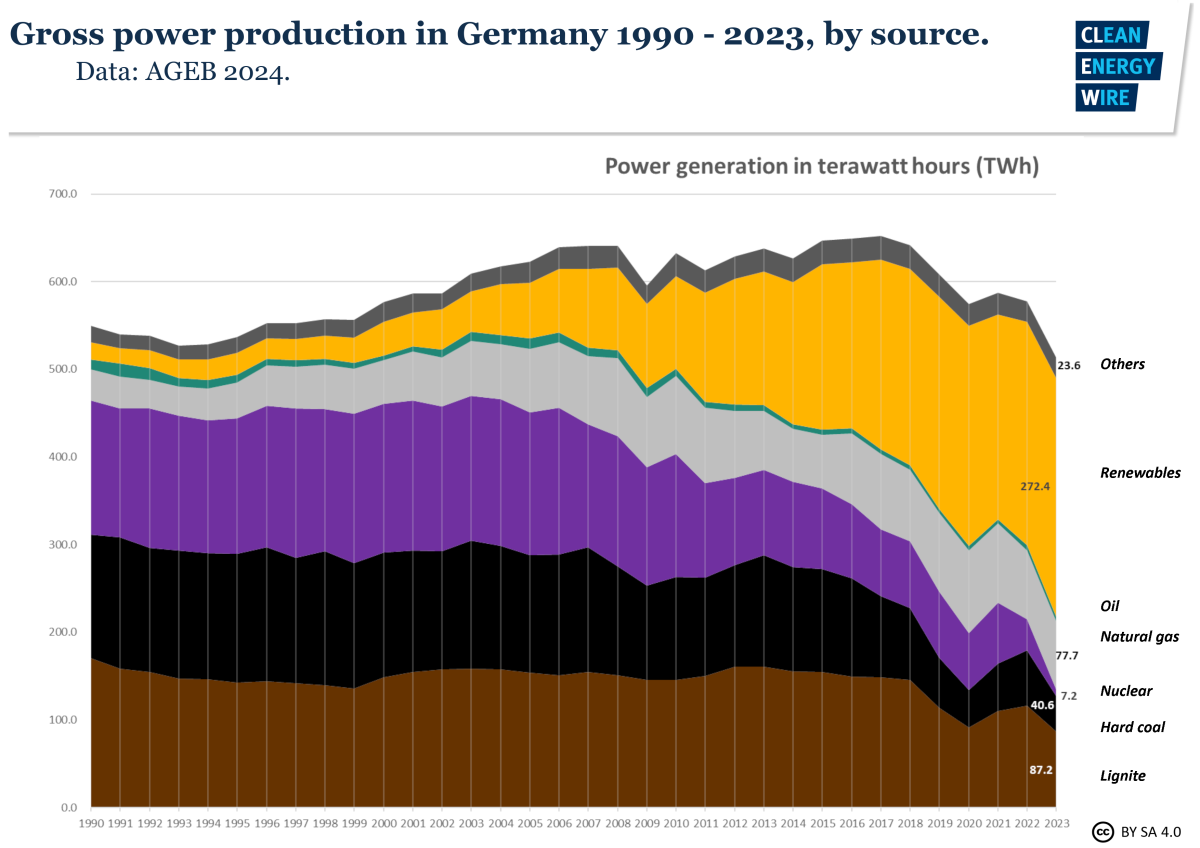

Gas had the lowest drop of the three large fossil fuels this year.

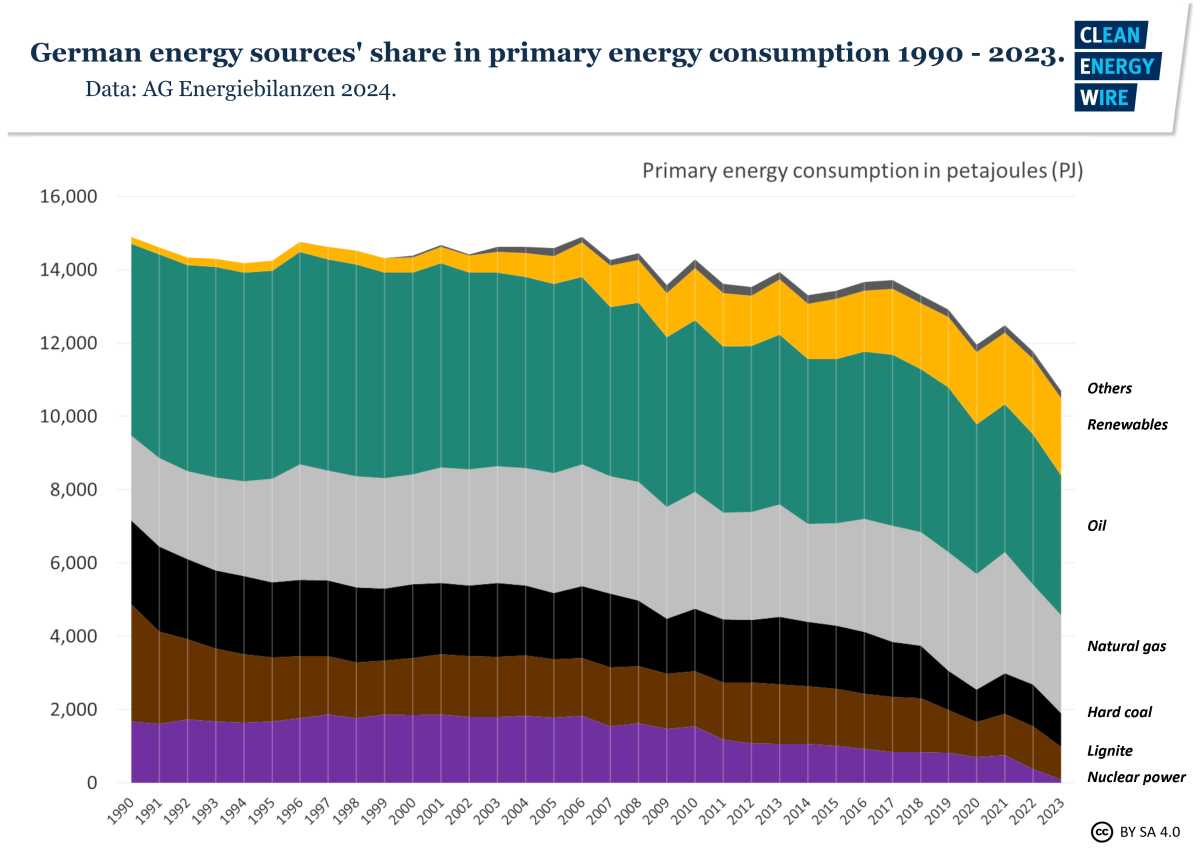

Covid was a huge change in behavior, it did not made it impossible to use infrastructure. As long as the war in Ukraine is still around, Germany is not going to import Russian gas. That means about half of Germany’s gas import infrastructure is politically unusable and partly even destroyed(NordStream). So the big change is a new heating bill, which bans new gas boilers in all buildings by 2028 at the latest and in most cases much earlier. That makes up half of Germany’s gas consumption. It also with some law changes started a boom in battery storage for grid regulation. That used to be a huge part of the need for gas power plants. These are rather quickly built and there are a lot of good sites on dismantled coal power plants. As for industry it is more complicated, but a lot of upgrades of gas infrastructure has been canceled for greener alternative due to the price shock and subsidies. Also a lot of district heating system operators are looking for alternatives for gas power plants.

Anyway the big drop happened in coal. Last year saw a massive increase in coal electricity production, due to the high gas price. That meant a high level, but due to low electricity consumption and a massive built up of solar and a decent one for wind that meant coal consumption has dropped very quickly. Next year will see 6GW of coal power plants being shut down. Solar built up is up, onshore wind permits are at record levels and offshore wind has seen some massive auctions. So coal has a hard time competing due to emissions pricing, falling gas prices and that. That means 2028 is likely to be the last year with any sort of large coal consumption for Germany. That is even more true as the other big consumer steel mills are being converted to hydrogen. All of the large ones have active projections with funding secured to be done by 2030.

As for oil the Covid story is somewhat untrue in Germanys case. Work from home caused a large dip and EVs are starting to lower the number of IC cars registered. Hard to say what will happen, but the EU wide sales ban for 2035 is still on the books and will very likely stay. However there are some trouble with subsidies.

However a lot of this will be permanent change to a lower status quo. I honestly doubt that even if Putin lets the gas flow freely, that it would return to normal.

That is hopeful news.

Great to hear. Thanks for sharing. 💚